The economic growth of India depends not only on large industries, but small businesses also play a vital role in creating local jobs and rural development. To make the system strong, the Indian government introduced various programs such as PMEGP. The scheme helps the entrepreneurs to turn their business ideas into reality by offering financial support, training, and easily available credit.

PMEGP continues to empower young entrepreneurs, women, and small business owners to start their manufacturing or service units without any struggle for capital. In this article, we will learn all the details about the PMEGP scheme 2026.

What is PMEGP?

The Ministry of MSME has introduced a credit-linked subsidy scheme and named it the Prime Minister’s Employment Generation Programme (PMEGP). It helps people start their microenterprises. Beneficiaries get bank loans with a government margin money subsidy. It is implemented through KVIC, state KVIB, and DICs. The scheme supports the manufacturing and service businesses in urban and rural areas of the nation. The main aim is to generate employment by empowering self-employment opportunities. It also encourages the emergence of sustainable small-scale industries in India.

PMEGP Subsidy Structure

| Beneficiary Category | Own Contribution | Bank Loan | Subsidy Urban | Subsidy Rural |

| General | 10% | 90% | 15% | 25% |

| Special Categories | 5% | 95% | 25% | 35% |

PMEGP Scheme List (Eligible Activities)

The list of the PMEGP scheme also includes various manufacturing and service activities, like:

- Food processing units

- Handicrafts and handloom

- Small manufacturing businesses

- Repair workshops

- Agro-based industries

- Service businesses- saloons, printing, tailoring

You can see the complete PMEGP scheme list pdf in official site for approved activities.

PMEGP Loan Details (2026)

Here are the major loan details of PMEGP 2026:

| Component | Details |

| Loan Amount | Up to ₹50 lakh for the manufacturing sector and up to ₹20 lakh for the service sector |

| Subsidy | Up to 35% of the total project cost |

| Interest Rate | As per RBI guidelines, generally between 11% and 12% |

| Repayment Tenure | 3 to 7 years, including a moratorium period |

| Margin Money | 5%–10% of the project cost to be contributed by the applicant |

Read more: Mukhyamantri Mahila Rojgar Yojana / www.ipcainterface.com

PMEGP Scheme Benefits

The following are the prime PMEGP scheme benefits:

- Grant of up to 35% on the total cost of the project

- Financial support for new businesses

- No requirement for loans till Rs 10 lakh

- Encourages rural industrial development

- Special concessions to women, SC/ST, OBC, minorities, and PwD

- Training support through EDP programs

- Promotes self-employment and job creation

PMEGP subsidy & project cost

| Beneficiary category | Promoter’s share (own contribution) | Bank loan share | Subsidy (Urban) | Subsidy (Rural) |

| General (individuals) | 10% | 90% | 15% | 25% |

| Special categories (SC/ST/OBC/Women/Minorities/Ex-servicemen/PwD/NE & hill areas) | 5% | 95% | 25% | 35% |

Read more: Har Ghar Bijli Yojana | Bihar Laghu Udyami Yojana | EPDS Bihar

PMEGP Eligibility Criteria

If you want to apply for the PMEGP Scheme, you need to fulfill some eligibility criteria as mentioned below:

- The age of the applicant must be 18 years

or older.

- Self-help groups and Joint groups are also eligible to apply.

- The registered institutions, such as societies, charitable trusts, and subsidiary cooperatives working in productivity activity, can also apply.

- Only 1 person from a family can get the benefits.

- Already existing units can apply for expansion or upgradation only.

- SC/CT/OBC/Women/Minorities/ ex-servicemen/ physically disabled people get more subsidies and easy terms and conditions.

Project types & cost ceilings

The details of project types and cost ceilings are mentioned below:

- Manufacturing projects have higher admissible project costs than the service units.

- Services and business units enjoy lower caps.

- Upgradation projects have higher allowable maximums.

- North-East & hill states get maximum subsidy limits for regional development.

Read more: Pm Awas yojana / Bhulekh bihar khata khesra / Bihar Bhu Naksha

Document required for PMEGP Scheme

You will require some documents for applying for PMEGP and the verification process.

- Aadhaar Card and PAN Card

- Residential proof – voter ID, Ration card, passport, Utility bills

- Passport-sized photograph

- Project report, Business brief

- Educational certificate

- Cast certificate

- Bank details and KYV documents

- Any other local or state-level certificates (If needed)

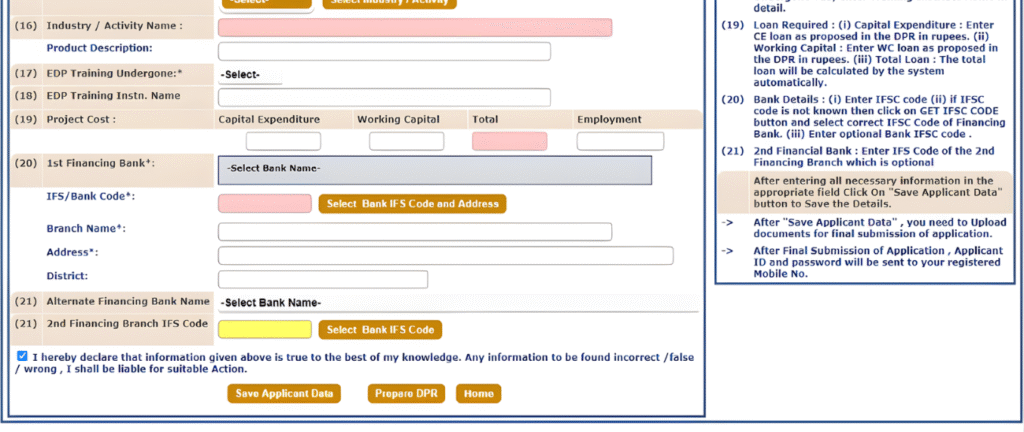

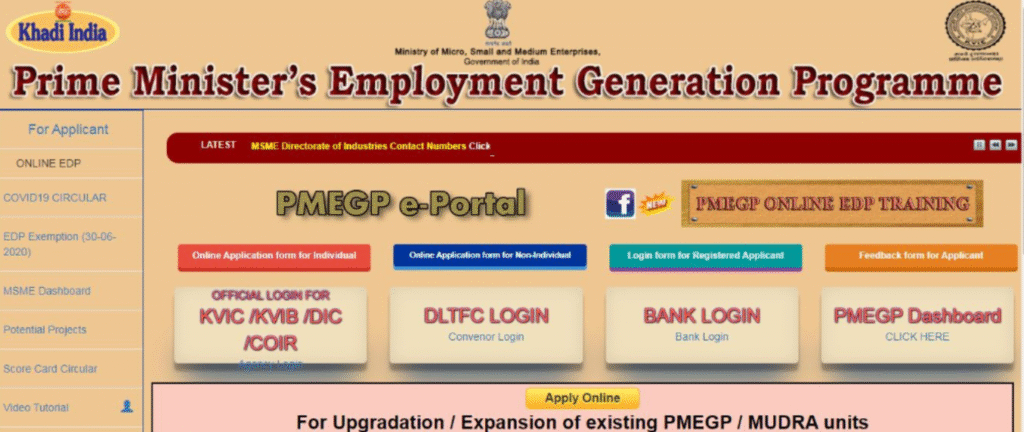

Step-by-step online application process for PMEGP

Here is the detailed application process for the PMEGP Scheme:

- Check your eligibility details on the PMEGP e-portal.

- Validate your Aadaar online to generate the user ID on the portal. You can also take help from the KVIC office.

- Fill the online form, including your project details, and upload the required documents.

- Undergo basic training EDP. You can check the local implementing agency requirements. KBIC/DIC may require or offer the EDP certificate.

- At the bank verification step, the bank will validate the project and then sanction the loan. The subsidy amount will be sent to your account or adjusted as per the rules.

- After all the verification, your loan will be disbursed, and the government will monitor ot for proper and fair utilisation.

PMEGP Scheme vs Other Government Loan Schemes

| Scheme Name | Target Group | Loan Amount | Collateral | Special Benefit |

| PMEGP | New entrepreneurs (rural/urban) | Up to ₹50 lakh | No (up to ₹10L) | Subsidy up to 35% |

| MUDRA | Micro/small units | Up to ₹10 lakh | No | No subsidy, easy processing |

| Stand-Up India | SC/ST/Women entrepreneurs | ₹10 lakh – ₹1 crore | Yes (above ₹10L) | Equity funding, inclusive focus |

| CGTMSE | MSMEs (new & existing) | Up to ₹5 crore | No (with scheme cover) | Credit guarantee to support MSME loans |

Also Read: Udyogini Scheme |Sumangala Yojana

Common pitfalls & how to avoid them?

You might face several difficulties applying for PMEGP or getting loan approval. Here are the things to remember:

- If your project report is weak, your loan will be rejected. Don’t make an unrealistic project estimate.

- Make sure you have uploaded all the documents correctly. Also, keep the original documents handy for verification.

- Some states in India require EDP training; you must not skip it.

- If you belong to a special category, you must have the certificate.

- Take help from the local DIC, KVIB, and KVIC with application liaison and follow-up.

Conclusion

The PMEGP scheme is one of India’s strongest schemes for supporting self-employed and small-scale entrepreneurs. It offers subsidies, and the simple guidelines help people to leverage the benefits easily. It empowers beneficiaries to start their sustainable manufacturing units or service units; the entrepreneurs are not required to take on any financial stress with PMEGO support. The scheme is encouraging rural industrialisation and strengthening India’s economy,

(FAQs): About PMEGP Scheme

What are the eligibility criteria for the PMEGP scheme?

To apply for the PMEGP scheme, you must be an Indian citizen of 18+ years of age. Charitable trusts, self-help groups, and institutions are also eligible.

What loan amount is provided under the PMEGP Scheme 2026?

You can apply for a loan amount of up to Rs. 40 lakhs for manufacturing units and Rs. 20 lakhs for service businesses.

Is there any need for collateral for the PMEGP Scheme process?

No, PMEGP offers loans up to Rs. 10 lakhs without any collateral. The bank may ask you for some security for a higher loan.

How much is consumed in PMEGP loan approval?

From the day of filling the form, it may take 30-90 days to get the loan approval. The verification process and all the processes are time-consuming.

I have an existing business of manufacturing sandals. Can I also apply for PMEGP?

Yes, you can apply for the upgradation or expansion of your business. You must meet the conditions before applying, such as good profit and a track record.

Leave a Comment